Irs Aircraft - Under Section 274(e)(2)(A), a taxpayer may deduct entertainment expenses if the taxpayer treats the expense as compensation to its employee (e.g., a taxpayer spends $1,000 flying an employee to a sporting event but reports the $1,000 as wages

to the employee). Under Section 274(e)(9), a taxpayer can deduct entertainment expenses if the recipient is not an employee and the entertainment expense is treated as compensation for services rendered or as a prize or award (e.g., in exchange for painting his office,

Irs Aircraft

the taxpayer flies the painter on his plane but treats the value of the flight as compensation to the painter). Treas. Reg. § 1.274-10(e) provides the permitted methodologies for allocating expenses between the various individuals present on flights and creates a disallowance methodology that accounts for mixed use flights provided by an employer to its employees and independent contractors.

Federal Excise Taxes Fet

The 2023 NBAA Business Aviation Convention & Exhibition (NBAA-BACE) will return to Las Vegas, NV from October 17-19. Save the date and make plans to attend the biggest and most productive event of the year for business aviation.

Both private and commercial business aircraft operators pay Federal excise taxes (FET) either on fuel or on the transportation of persons or property. Learn about FET applicability, current tax rates, and best practices for collecting and remitting the tax.

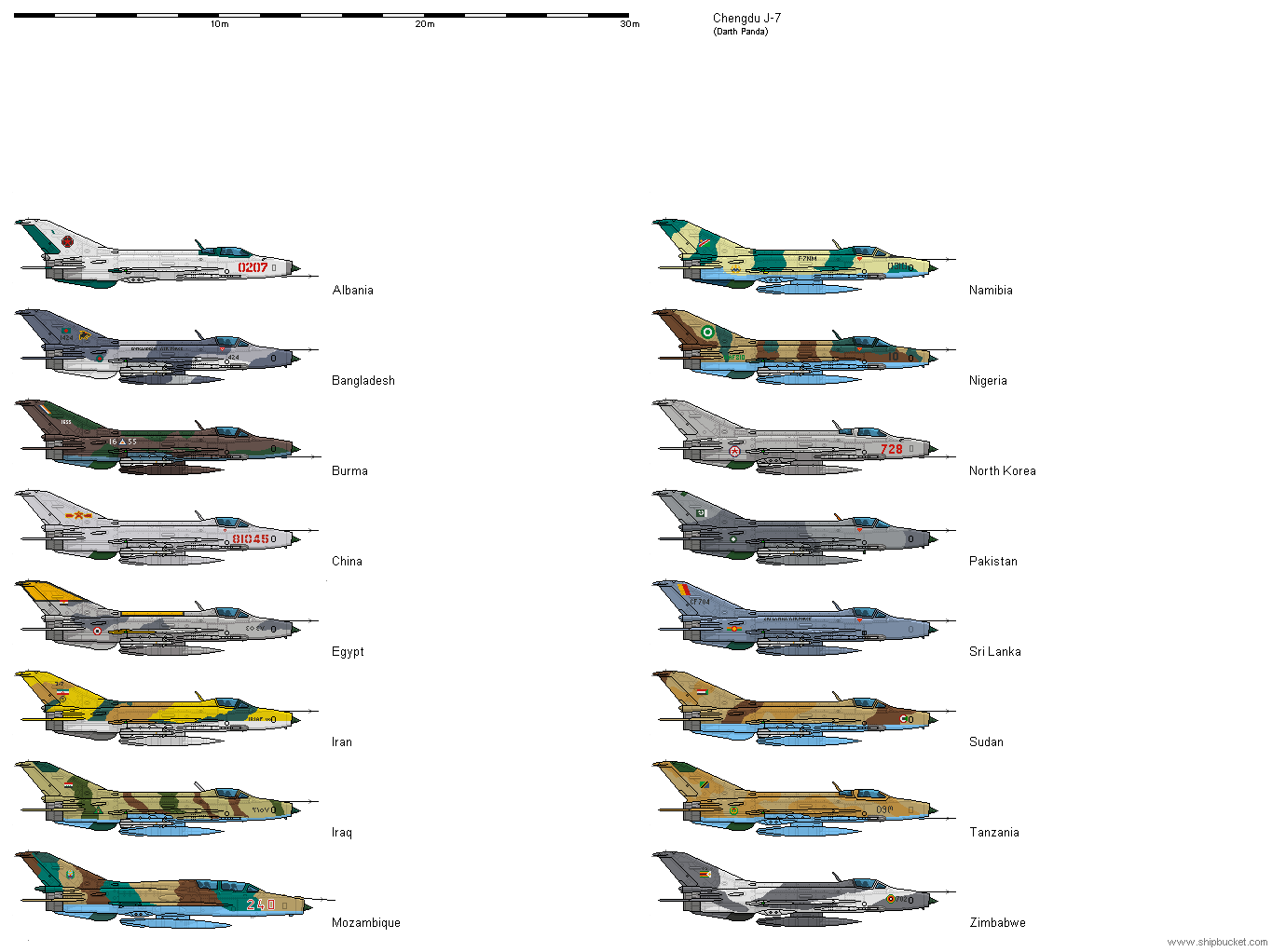

Commercial aircraft navigation systems consist of processes which provide a positioning system to the aircraft. These positioning systems communicate with the onboard navigation systems. This communication allows the exact location of the aircraft to be identified.

In the memo, the IRS states that entertainment compensation exceptions in Section 274(e)(2) and (9) do not apply to sole proprietors because a sole proprietor is not an employee of the sole proprietorship and does not receive compensation and wages from

Can Irs Be Aligned In The Air?

the sole proprietorship. Instead, the IRS said a sole proprietor should use Section 162's primary purpose test to determine whether its aircraft related expenses are deductible. Accordingly, if the sole proprietor's primary purpose for the trip is business, the aircraft expense is deductible under Section 162 even if there are passengers on the aircraft who are traveling for personal reasons.

IRS systems require gravity to fully align. This means the aircraft must be on the ground and stationary in order for the IRS to align completely. This can be verified via the Weight on Wheels (WOW) system.

While a full IRS alignment cannot be completed in the air, limited components can be aligned utilizing a separate mode known as ATT. © 2023 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee.

All rights reserved. The IRS Large Business and International (LB&I) division publicly released a “practice unit”—part of a series of IRS examiner “job aides” and training materials intended to describe for IRS agents leading practices about tax concepts in general and specific types of transactions

Tax Cuts And Jobs Act

. For example, assuming that a spouse accompanies an executive on a business trip, the company may not deduct one half of the cost of that business trip (assuming only the two passengers are aboard), except to the extent that the amount attributable to the spouse's

travel is included in the executive's income. Generally, a corporation's actual cost of a flight will significantly exceed the IRS's standard industry fare level or fair market valuation amount that is includible in an executive's taxable wages for that flight.

Passed into law in December 2017, the Tax Cuts and Jobs Act (TCJA) has implications for business aircraft owners and operators. In addition to lowering the corporate tax rate to 21 percent, the TCJA provides for immediate expensing of capital investments, repeals like-kind exchanges and makes a host of other changes that impact business aviation.

One key issue for business aircraft owners and operators is the income tax treatment of expenses relating to flights on board aircraft operated for both business and personal reasons. Under Treas. Reg. § 1.162-2(b)(1), a taxpayer can deduct the expense of such trips only if the trip is related primarily to the taxpayer's trade or business (the “primary purpose test”).

Irs Memo Sole Proprietors And Aircraft Related Expenses

If the trip is primarily personal, the traveling expenses are not deductible. Of course, the taxpayer can still deduct the expenses at the destination that are properly allocable to the taxpayer's business (i.e., the taxpayer cannot deduct the cost of flying to a family wedding but he can deduct the business meal he had with a client the night

before). The position of the aircraft in co-ordinates will affect the alignment time. This is due to the system determining the aircraft's position relative to the earth's rotation. The further from the equator, the longer the alignment time will be.

This is due to the difference in the earth's rotation at different locations around the globe. The earth's rotation is faster the closer the equator is and therefore alignment time will be shorter. The final regulations define a "specified individual" as any individual who is subject to the requirements of Section 16(a) of the Securities Exchange Act of 1934 with respect to the corporation or any subsidiaries of the corporation as well as any individual who would be

subject to the Section 16 reporting rules if the corporation (or any of its subsidiaries) were subject to these reporting rules. This would generally include officers (as defined for Section 16 purposes), directors, and 10% shareholders of corporations.

Overview Of Relevant Code Sections Section And Section

The IRS recently issued a legal memorandum addressing how a sole proprietorship determines whether it may deduct aircraft related expenses it incurs. In the memorandum, the IRS took the position that a sole proprietor should apply Code Section 162’s primary purpose test instead of using the expense allocation rules set forth in Treas.

Reg. 1.274-10 to determine whether such expenses are deductible. However, in a likely to be disputed move, the IRS also said that taxpayers still need to use a reasonable method other than the primary purpose test for allocating expenses for flights containing passengers being flown for entertainment purposes.

However, the IRS also noted that Section 274's general disallowance on deducting entertainment expenses may still apply even if the primary purpose for the trip is related to the sole proprietor's business. The IRS explicitly states that taxpayers cannot use the primary purpose test to allocate expenses between entertainment and non-entertainment passengers and that the use of such a method is not reasonable.

Instead, the IRS states that the sole proprietor must use a reasonable method other than the primary purpose test to allocate expenses relating to each flight between business and entertainment uses when entertainment passengers are on board the aircraft.

Irs Alignment

On IRS systems, there is navigational capability for the “Reference” component of the system to communicate with the navigation systems onboard. This communication includes providing speed, position and heading of the aircraft to the navigation portion of the Flight Management System (FMS).

Another critical issue for aircraft owners involves travel expenses of family members accompanying a sole proprietor on a trip. Under Section 274(m), a taxpayer generally cannot deduct the expenses of a spouse, dependent, or other individual accompanying the taxpayer (or an officer or employee of the taxpayer) on business travel.

Such expenses are deductible only if (1) the spouse, dependent, or other individual is an employee of the taxpayer or (2) their travel is for a bona fide business purpose and such expense would otherwise be deductible by the spouse, dependent, or

other individuals. Another key issue is the income tax treatment of entertainment related expenses incurred by a taxpayer. The Code generally bars taxpayers from deducting expenses related to entertainment activities. This restriction also prohibits deduction of costs pertaining to the use of an entertainment facility, including aircraft.

Note that the regulations permit a taxpayer to elect to calculate depreciation expenses on a straight line basis for all of the taxpayer's aircrafts for all taxable years for purposes of calculating disallowed expenses, even if the taxpayer uses another method to compute depreciation for other purposes.

In order to ensure that the sum of allowable and disallowed depreciation will not exceed 100 percent of an aircraft's tax basis, the regulations provide that the amount of the depreciation disallowance in any given year may not exceed the amount of the allowable depreciation for that taxable year

. Special transition rules apply for aircraft placed in service before this election was made. Despite commentator requests that the disallowance only extend to direct variable costs of operating the aircraft such as fuel and landing fees, or costs paid or incurred for aircraft leased or chartered to the taxpayer, the final regulations provide that expenses subject to disallowance also include fixed costs

such as hangar fees, pilot salaries, management fees, maintenance, insurance, registration, certificate of title, depreciation, interest on debt secured by or properly allocable to an aircraft and other items not related to any specific, individual flight.

The final regulations also rejected commentator requests for a charter rate safe harbor method for determining costs. Expenses of aircrafts of similar cost profiles may be aggregated to calculate expenses subject to the disallowance. Generally, Internal Revenue Code ("Code") Section 162(a) allows a corporation to deduct all ordinary and necessary expenses paid or incurred during a taxable year in carrying on a trade or business.

This generally would include the costs of operating company property, such as aircraft, used for business purposes. However, under Code Section 274, when executives or directors and other "specified individuals" travel on company aircraft for entertainment, amusement, or recreation purposes, a company's deduction is limited to the amount includible as compensation in such individual's income.

In the final regulations, the IRS rejected a proposed "primary purpose test" for determining whether a flight is for "entertainment, amusement, or recreation purposes." The primary purpose test would have disallowed only the additional or incidental costs associated with specified individuals traveling for entertainment purposes, if the primary purpose of the flight was for business purposes.

Under the final regulations, even if the primary purpose of a flight is for business reasons, the company may not deduct the portion of the cost of the flight allocable to specified individuals traveling aboard the flight for entertainment purposes.

The 2024 NBAA Maintenance Conference provides vital education and networking opportunities for anyone involved in business aircraft maintenance – from technicians to directors of maintenance. Stay up-to-date on the latest operational information critical to your job and connect with over 900 fellow peers.

Founded in 1947 and based in Washington, DC, the National Business Aviation Association (NBAA) is the leading organization for companies that rely on general aviation aircraft to help make their businesses more efficient, productive and successful.

If you're interested in elevating your career to the next level, look no further than SDC2025. You’ll learn current best practices and trends from industry experts and fellow attendees through top-level education sessions and critical peer-to-peer networking to help you work smarter, not harder in the year ahead.

The 2024 NBAA Maintenance Conference provides vital education and networking opportunities for anyone involved in business aircraft maintenance – from technicians to directors of maintenance. Stay up-to-date on the latest operational information critical to your job and connect with over 900 fellow peers.

With an INS system, the above reference functionality is maintained along with the capability for data to be utilized for navigation purposes on a position to position basis. This system can provide lateral guidance independent of the FMS navigation system.

If you're interested in elevating your career to the next level, look no further than SDC2025. You’ll learn current best practices and trends from industry experts and fellow attendees through top-level education sessions and critical peer-to-peer networking to help you work smarter, not harder in the year ahead.

The IRS memo addresses how a sole proprietor determines the deductibility of expenses relating to the sole proprietor's ownership and operation of aircraft. The memorandum addresses sole proprietors who report their business activity on Schedule C to an IRS Form 1040 and who wholly own and operate a business in either (1) their own capacity or (2) through a single-member LLC which is disregarded as an entity

separate from its owner for federal income tax purposes. For partnership purposes, a specified individual includes any partner that holds more than a 10% equity interest in the partnership and any general partner, officer, or managing partner of the partnership.

Specified individuals of other partnerships that are under common ownership with the partnership will also be treated as specified individuals of the partnership. Ronald O. Mueller - Washington, D.C. (202-955-8671, rmueller@gibsondunn.com)Amy L. Goodman - Washington, D.C. (202-955-8653, agoodman@gibsondunn.com)Stephen W. Fackler – Palo Alto and New York (650-849-5385 and 212-351-2392, sfackler@gibsondunn.com)Michael J. Collins – Washington, D.C.

(202-887-3551, mcollins@gibsondunn.com) David I. Schiller – Dallas (214-698-3205, dschiller@gibsondunn.com) Elizabeth Ising – Washington, D.C. (202-955-8287, eising@gibsondunn.com) Sean Feller - Los Angeles (213-229-7579, sfeller@gibsondunn.com) Krista Hanvey - Dallas (214-698-3425, khanvey@gibsondunn.com) In addition, a "specified individual" is treated as using company aircraft if such use is provided to another individual because of his or her relationship to the specified individual and such use is a fringe benefit to the specified individual under Code Section 61(a)

(1). The memo is helpful since it confirms that sole proprietors should use the primary purpose test described above when making the threshold determination as to whether aircraft related expenses, including depreciation, are deductible. However, the IRS's statement that the primary purpose test is not a reasonable method for determining the amount of any disallowed expenses without providing another methodology for making such a determination leaves open the question of what methodologies the IRS will accept as reasonable.

Planning for the team's future is one of a leader's most important responsibilities. A solid plan makes it easier to navigate today's uncertain world and when priorities change or a crisis happens, a well-crafted plan will help keep the team on track.

Taxpayers are generally allowed to deduct all the ordinary, necessary and reasonable expenses paid or incurred in carrying on their trade or business. However, the Internal Revenue Code and Treasury Regulations contain special rules relating to the deduction of travel and entertainment expenses that are designed, in part, to prevent taxpayers from engaging in potentially abusive transactions that enable the deduction of otherwise personal expenses as business expenses.

aircraft irs systems, irs aircraft depreciation, airplane irs, inertial reference system aircraft, personal use of aircraft irs, airplane expenses deductible, irs airplane tax deductions, airplane tax deduction

/2022/12/02/image/jpeg/jI5q8dCwTHPAcY6XPh1twBO3KZVwidNqw5QeJYgk.jpg)